Today marks the return of the annual Pebble Beach Concours d'Elegance, which has been one of the biggest events in the classic car calendar since its inaugural event in 1950.

Tens of thousands of visitors will turn out at the resort to see some of the world's most stunning motors.

For collectors, it's an opportunity to acquire some of the most exclusive cars on the planet.

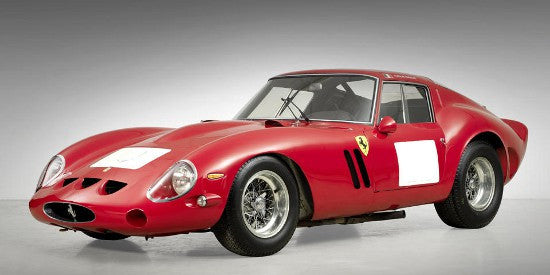

Five of the world's biggest automobile auctioneers (including Mecum, Bonhams and Gooding & Company) will offer a jaw dropping array of lots - including a 250 GTO Berlinetta that could set a new world auction record.

Ferrari GTOs are undoubtedly the most desirable cars on the planet - can this one re-ignite the classic car market this week? |

If you've been following our coverage of the HAGI classic car index this year, you'll realise that this series of sales is likely to be the shot in the arm the classic car market needs.

Let me explain.

In 2013, we saw unprecedented growth across the board, with the index closing up 47%. Ferrari performed particularly well, up 62.1%.

The problem is that this kind of growth is unsustainable in the long term.

It has resulted in a relatively severe market correction this year, which has seen values (comparatively) stagnate.

So a series of high profile sales, including a potential world record, is just what the doctor ordered to re-ignite the market.

Of course, this effect isn't limited to classic cars.

Marilyn Monroe

Debbie Reynolds' auction of Hollywood memorabilia in 2011 had a similar impact. The auction was headlined by Marilyn Monroe's iconic Seven Year Itch dress, which set a new movie memorabilia world record of $5.6m.

This has since led to substantial growth in the Monroe memorabilia market. Her memorabilia now appears more attractive to investors than ever before and this is reflected in its value.

Francis Bacon

Or take the $142m sale of Francis Bacon's Three Studies of Lucian Freud last year - the most valuable artwork ever auctioned. Since then demand for Bacon's lesser works have gone through the roof.

What's my point?

In short, keep an eye out for landmark auctions.

They are often a sign of where the market is headed - use them to inform your investing.

Thanks for reading,

Paul