Do you read my emails often? Then you’ll know I advocate investing in rare collectibles.

After all, it’s how I’ve made my livelihood.

And I’ve seen client after client protect and grow their wealth with rare objects they’ve purchased from me.

But you don’t have to take my word that investing in collectibles is a good idea.

An independent collectibles investment report has arrived on my desk. From the global consultancy Knight Frank.

Knight Frank’s Luxury Investment Index demonstrates, in clear numbers, that:

Investing in collectibles provides powerful diversification for your portfolio.

Here’s a summary of the key points for you.

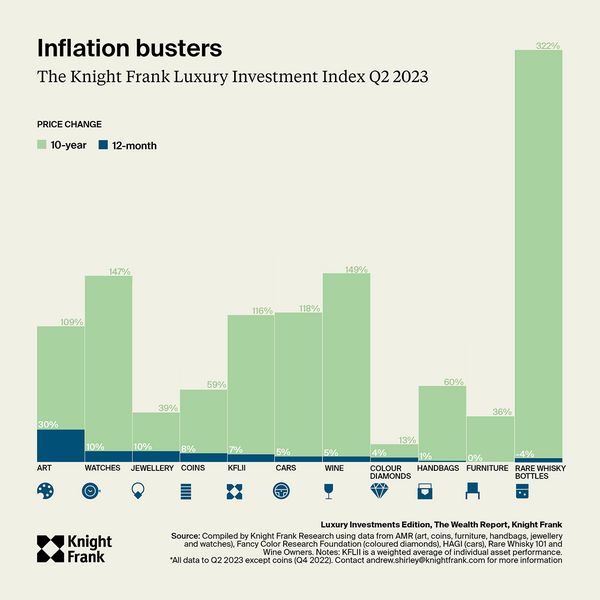

The Knight Frank Luxury Investment Index (KFLII) tracks a basket of 10 collectible sectors.

- The index rose by 7% in value in the 12 months to June 2023

- It increased by 116% in value in the 10 years between 2013 and 2023. That’s 11.6% a year on average

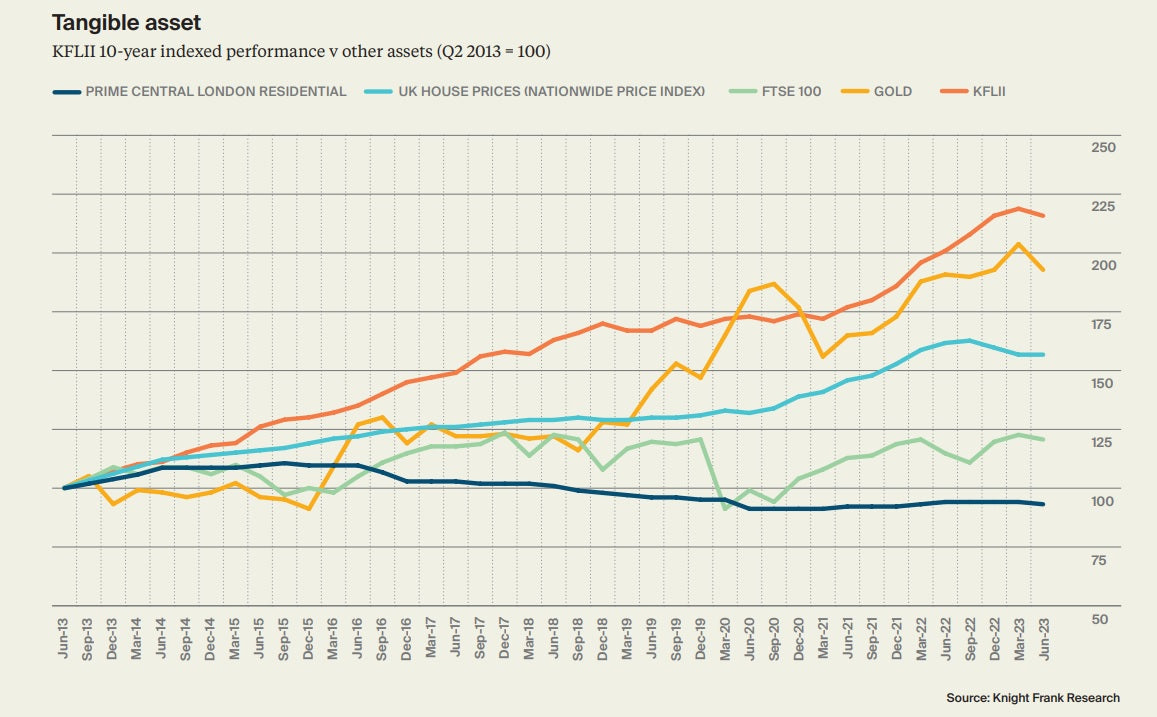

- It beat gold, UK property and the FTSE100 over the 10 years

The red line shows the gold-beating growth in value of rare collectibles since 2013

Let's view some individual collectibles sectors:

Rare watches

- Vintage Rolex professional watches dominate the collector market: Rolexes were up 10% in the 12 months to June 2023

- Patek Philippe wristwatches were up a strong 7% in the 12 month period

View our investment-grade wristwatches for sale now

Rare coins

- Up 8% in the 12 months to June 2023

We have an enticing selection of coins available for investment today. More are coming soon.

Art

- Up 30% in the 12 months to June 2023

- According to Sotheby’s, the artists most traded in private sales include Andy Warhol, Yoshitomo Nara and Eddie Martinez

Discover our investment-grade artworks here.

Handbags

- Fast moving: The average hammer price achieved at auction house Bonhams has increased by 154% over the past 3 years, indicating there is huge demand for pre-loved designer handbags

- Hermès remains the most popular brand at auction: A 2020 Credit Suisse report supports the positive growth outlined by Knight Frank. It states the annual price increase between 2010 and 2020 for Hermès Birkin bags was 5.7%

Have you seen our investment-level Hermes Birkin in stock? Click here

So, should you be diversifying into rare collectibles?

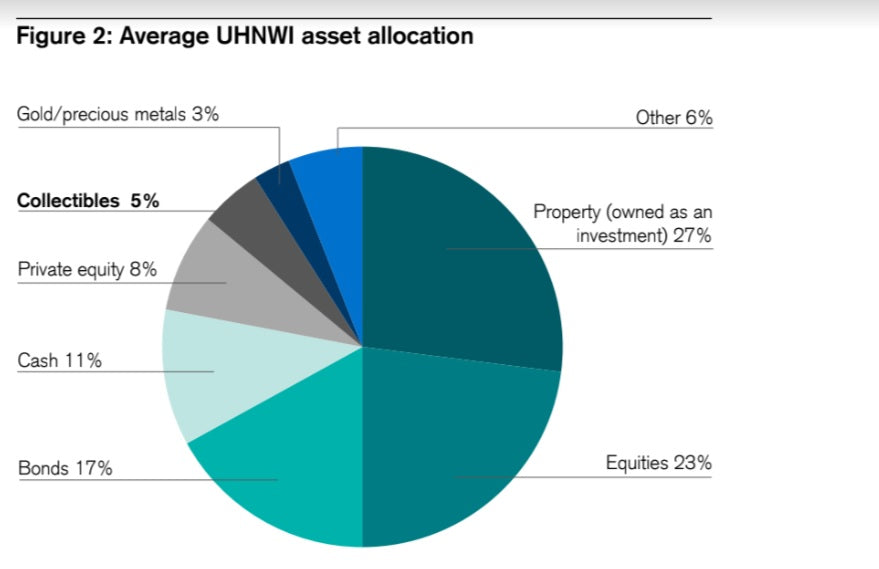

That's what the smart money does. The average ultra-high-net-worth individual invests 5% of their wealth in collectibles.

As Michael Strobaek, Global CIO of Credit Suisse, explains:

“More than 70% of our high net worth clients are collectors. Most clients I meet have 'a passion' that they make part of their investment portfolios, such as watches, classic cars, paintings.

“Nearly half of our clients say they hold 2%–5% of their wealth in collectibles and 15% have collectibles worth 5%–10% of their total wealth.”

Collectibles form 5% of the average ultra-high-net-worth's investment portfolio (courtesy Credit Suisse)

Collectibles form 5% of the average ultra-high-net-worth's investment portfolio (courtesy Credit Suisse)

The collectibles market is in excellent health. I've already been investing this year. Perhaps you should too.

Next steps

Investing in collectibles could be right for you.

Contact me on info@paulfrasercollectilbes.com or +44 (0)1534 639 998 now to set up a call with one of our friendly and knowledgeable team.

We'll discuss your passions and your investment goals. And answer any questions you have. There will be no obligation to purchase anything. And there never will be.

Look forward to hearing from you.

Until next time,

Paul Fraser

Are you following us on social media? Find us here:

Facebook | Twitter | Instagram | Pinterest | Youtube