September has seen mixed results for the classic car market according to the HAGI Classic Car Indices.

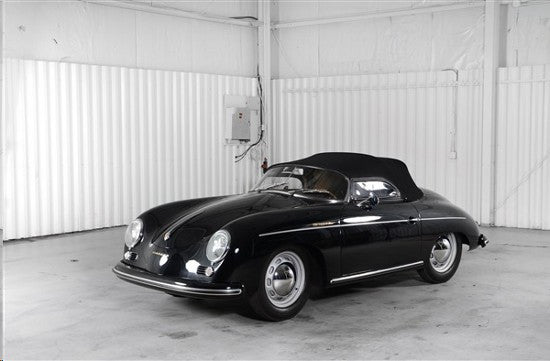

Porsche prevails as the market witnesses a welcome slow down |

The Historic Automobile Group International's benchmark HAGI Top Index has seen a 1.0% increase to reach a new all-time high, yet third quarter results stand at 8.4% with year to date growth of 12.1%.

That growth is less than half of the gains seen in the year to September 2013, which indicates that the extraordinary boom of the classic car market is slowing somewhat. This is actually good news for investors, however, with a slowdown far preferable to a bubble, feared as prices began to soar to unsustainable highs last year.

Porsche has seen some of the most positive results, with a 3.6% rise in September pushing the marque to gains of 24.2%. Ferrari saw a slight increase of 2.8%, while other marques fell by 1.7% according to the HAGI Top-ex P&F, which tracks top collectible classics excluding Porsche and Ferrari.

However, the Top-ex P&F has increase by 25.2% over the year to date.

Please sign up to our free newsletter for more exciting news from classic car auctions.